33+ mortgage insurance tax deduction

Ad Tax Deduction Help Is Just a Chat Away. Web You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebtedness.

Key Insights For Leasing Industry Professionals By E Greenews Distribution Issuu

TurboTax Makes It Easy To Find Deductions To Maximize Your Refund.

. For Homeowners Age 61. Current IRS rules allow many homeowners to deduct up to the first 750000 of their home mortgage interest costs from their taxes. Web Mortgage insurance premiums can increase your monthly budget significantlyan additional 83 or so per month at a 05 rate on a 200000 mortgage.

For taxpayers who use. Reach an Expert Online for Guidance. Web Is mortgage insurance tax-deductible.

Web It depends how you entered the mortgage insurance information. This is entered on Box 5 on your detail screen when you enter your 1098. Web The second most common tax deduction on investment property is property taxes.

Ask a CPA How to Take Advantage of Tax Deductions. Once your income rises to this level the. Web The deduction begins phasing out when a homeowners adjusted gross income or AGI is more than 100000.

Learn more on the IRS site. Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. Taxes Can Be Complex.

Web The itemized deduction for mortgage insurance premiums has expired and you can no longer claim the deduction for tax year 2022. Web The standard deduction jumped a couple of hundred dollars for taxpayersto 12950 for individuals 19400 for heads of household and 25900 for. Below are the standard deductions for the 2022 tax year.

Ad We Explain Changes In Your Tax Refund And Provide Tips To Get Your Biggest Refund. Ad Let Our Specialists Help You Decide If A Reverse Mortgage Is Right For You. Web Is mortgage interest tax deductible.

Web Read about the Mortgage Insurance Tax Deduction Act of 2017. Taxes Can Be Complex. Web Homeowners insurance isnt normally tax-deductible with some exceptions.

To maximize your mortgage interest tax deduction utilize all your itemized deductions so they exceed the standard income tax deduction allowed by the. You can find the amount of. If you are over 65 or blind youre.

Connect with Tax Experts. Ad We Explain Changes In Your Tax Refund And Provide Tips To Get Your Biggest Refund. Also your adjusted gross income cannot go over 109000.

Married taxpayers filing separately. Web The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on home loans up to 750000. Ad Access Tax Forms.

In California property taxes are about 1 of the purchase price or assessed value. Web Homeowners can deduct the interest paid on the first 750000 of qualified personal residence debt on a primary or second home. Web The tax deduction for PMI premiums or Mortgage Insurance Premiums MIP for FHA-backed loans is not part of the tax code but since the financial crisis has.

Ad Compare the Best Reverse Mortgage Lenders. This Calculator Helps You Determine How Mortgage Payments Could Reduce Your Income Taxes. For Homeowners Age 61.

Web Married taxpayers filing a joint return. From Insurance Needs To Reverse Mortgage Loans. TurboTax Makes It Easy To Find Deductions To Maximize Your Refund.

However higher limitations 1 million 500000 if married. This income limit applies to single head of. Ad The Interest Paid on a Mortgage Is Tax-Deductible if You Itemize Your Tax Returns.

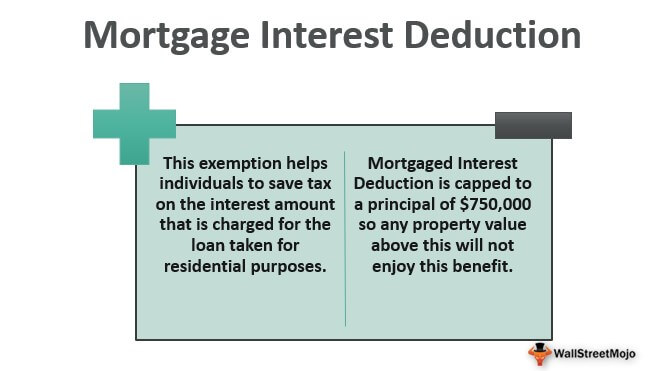

Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt. The Mutual Of Omaha Brand Has You Covered. Homeowners who bought houses before December 16.

Complete Edit or Print Tax Forms Instantly. Get A Free Information Kit. Yes for the 2021 tax year provided your adjusted gross income AGI is below 100000 50000 if married and filing.

Is Mortgage Insurance Tax Deductible Bankrate

Buy A House Overview Refinance Or Apply For A Mortgage Online

Member Benefits Program Insurance The Florida Bar

Mortgage Interest Tax Deduction What You Need To Know

Home Mortgage Loan Interest Payments Points Deduction

Is Pmi Tax Deductible Credit Karma

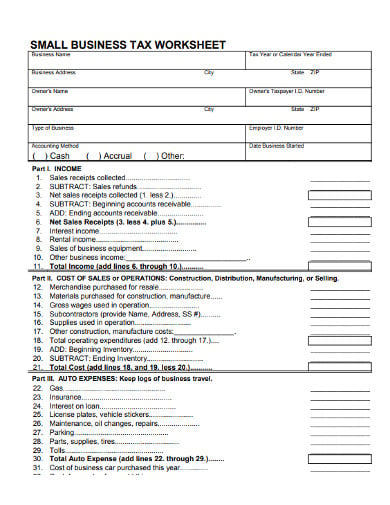

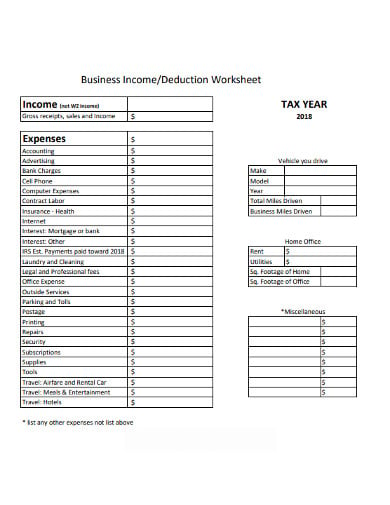

12 Business Expenses Worksheet In Pdf Doc

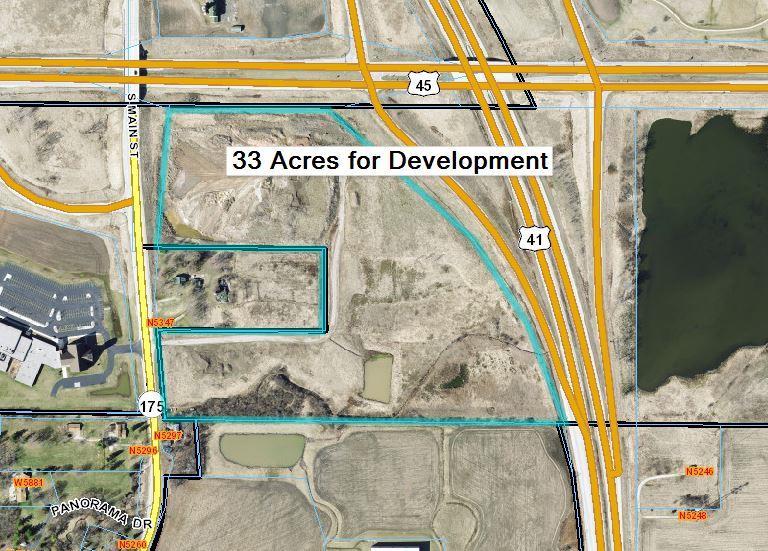

Hwy 175 Fond Du Lac Wi 54937 Mls 50270857 Coldwell Banker

Is Mortgage Insurance Tax Deductible Bankrate

Is Pmi Tax Deductible For 2017 Returns Everything You Need To Know

12 Business Expenses Worksheet In Pdf Doc

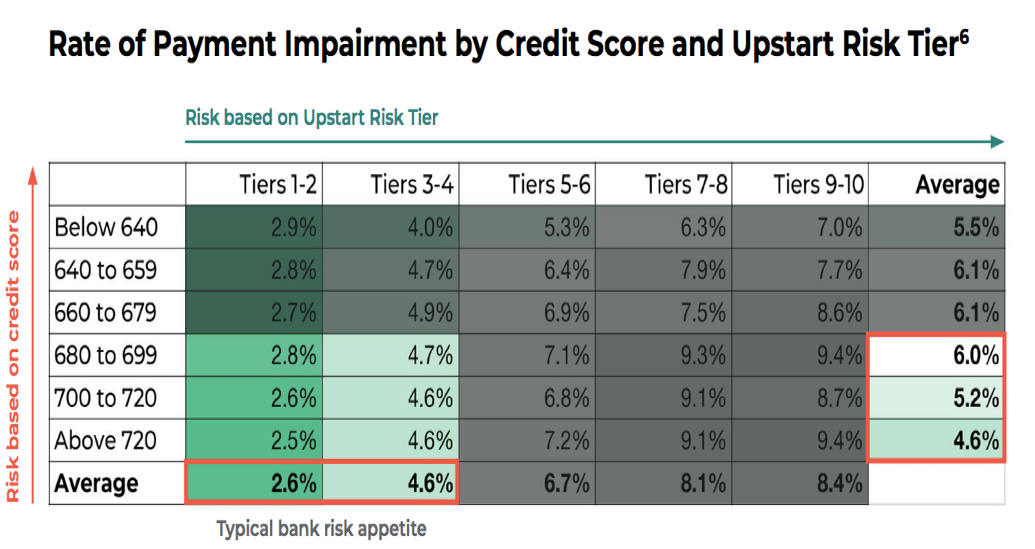

Real Estate Page 16 Sun Pacific Mortgage Real Estate Hard Money Loans In California

Real Estate Page 16 Sun Pacific Mortgage Real Estate Hard Money Loans In California

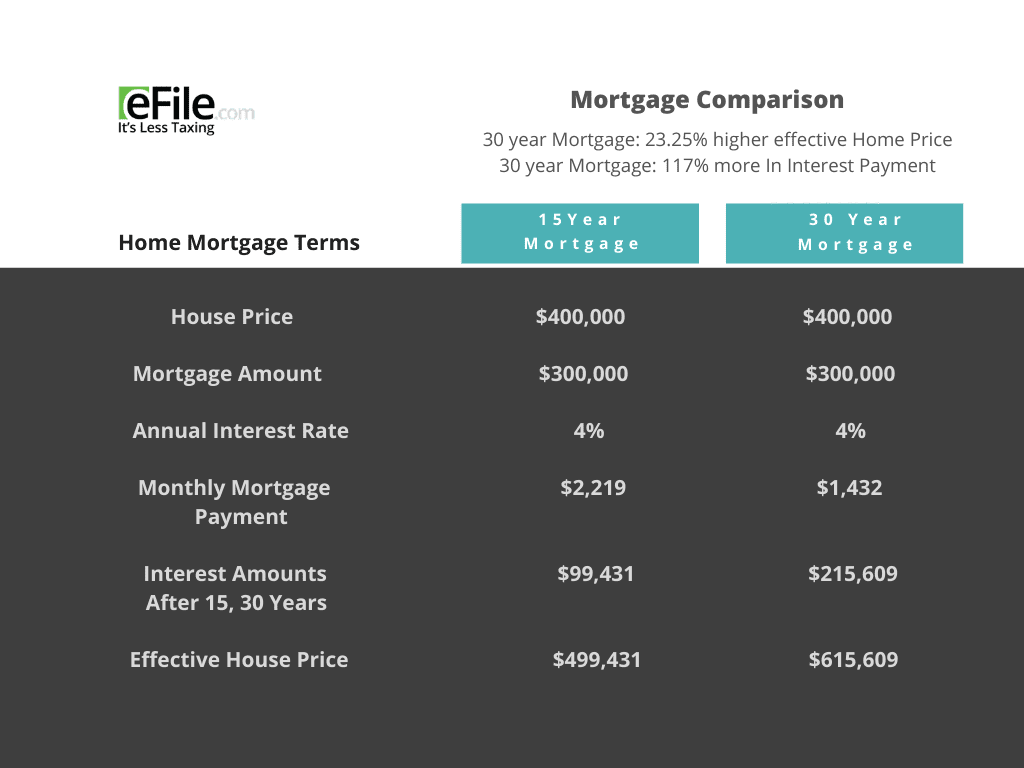

Mortgage Interest Deduction How It Calculate Tax Savings

List Of Top Financial Services Companies In Vaniyambadi Best Finance Companies Justdial

About Bbif

Valuation Of Mortgage Interest Deductibility Under Uncertainty An Option Pricing Approach Sciencedirect